Frequently Asked Questions

-

How much does the service cost?

Paid plans are based on a one year subscription and are designed to fit the smallest group's budget. You can sign up on-line using your PayPal account or you can send us a check by mail. See Products for more information regarding our pricing plans.

-

We would like to use Treasurer's Briefcase to manage multiple groups within our organization. Is this possible?

Currently, Treasurer's Briefcase does not group multiple clubs or organization's under one umbrella. Each booster club for example, in a High School requires its own subscription.

Future versions may support a method to manage and sign up multiple clubs. If you are interested in more information about discounts for a multi-group organization, please contact us to discuss your needs. -

How is Treasurer’s Briefcase different from other accounting software?

Treasurer's Briefcase was designed exclusively for small nonprofit organizations like yours! Our unique Simple, Fast and Easy system of record keeping works for a wide variety of nonprofits like PTOs, Booster Clubs, Home Owners Associations, and Youth Sports leagues. Any small nonprofit will find that Treasurer's Briefcase will work perfectly for them.

Our software was designed by CPAs who have both supported small nonprofit organizations with their accounting services and who have been volunteers for nonprofits for over 20 years. They understand the unique needs of the Treasurer and have designed the software just for them. Treasurer's Briefcase is not complicated like some accounting packages can be, yet it’s not overly simplistic like spreadsheets that lack the needed features that allow you to properly report finances. Treasurer's Briefcase was designed to be Simple, Fast and Easy yet accurate and reliable. -

How do I get started?

Sign up for the Trial, Budget or Standard plan. You can upgrade at any time.

All you need is a starting bank balance from your bank statement and you're ready to begin! We provide customizable category templates that will have many of the categories common to most non-profit organizations. Get started now! -

Will it be difficult to switch to Treasurer's Briefcase?

No! All you need is the balance from your last bank statement and you can switch to our software today! You can enter the previous year's data if you'd like, but you can start with a clean slate too.

Using Treasurer's Briefcase means you'll never have to worry whether the new Treasurer has Quickbooks, or Microsoft Excel, or any other off-the-shelf program that might prevent a smooth transition. The old Treasurer simply adds the new Treasurer as an administrative user and the new Treasurer deactivates the old Treasurer.

Voila! Transition complete!

The new Treasurer takes over with all the financial history and documents in one convenient electronic briefcase. -

What if I need help?

Paid accounts can receive help via email by sending us a note or question via the Contact Us page. We will respond to your question within 48 hours.

If you have selected the Standard plan you can also receive help right away over the phone from our knowledgable staff.

Trial accounts do not have access to support at this time, however can look for help via our Resource Center or the FAQ section. -

Does cloud base software really mean it’s portable?

Yes! Treasurer's Briefcase only requires a browser and internet access. We've tested our software with Internet Explorer (8 and 9), Firefox, Safari (Mac), and Google's Chrome browser.

-

What about backups?

You'll never have to worry again about backing up your data or whether your treasurer is backing up your data. Our cloud based databases are continually backed up.

-

What about the security of our data and our privacy?

All of your data is stored in your own database, accessible to only your users.

All documents sent to Treasurer's Briefcase are encrypted when they are stored - only by using your pin number can you unlock your Briefcase.

As per our privacy policy we will not share your information with any other entity unless you opt in to receive information from our partners or affiliates.

Keep in mind that no system can guarantee that they will never be compromised, however we take security very seriously and implement best practices with regard to our development and production servers.

User's should be careful to store only information that is necessary and redact (black out) information that is personal or private and not required for reporting purposes.

Sensitive data like Social Security or Tax Identification numbers are always stored in an encrypted fashion in our databases. -

What about downtime?

Treasurer's Briefcase is available 24 hours a day, 7 days a week. Our service is hosted on the same computers used by Amazon. Amazon's cloud services, which power Treasurer's Briefcase are reliable and secure. For more information about just how reliable visit Amazon's Web Services page.

-

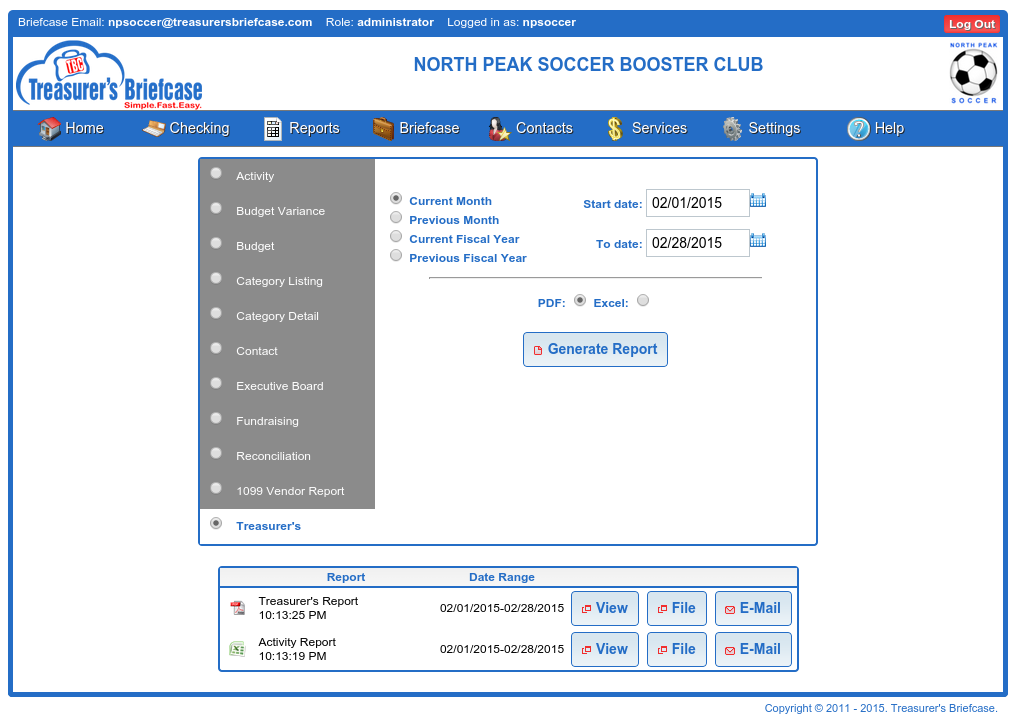

Are your reports easy to understand?

CPAs who make a living reporting results to businesses and non-profits designed the reports so they are clear, simple and very easy to understand. The CPAs used their years of working with non-profits to create reports that address almost every reporting need of your members and board and are formatted to assist on your state and federal tax filings.

-

Does Treasurer's Briefcase support multiple checkbooks?

Yes! Many organizations maintain more than one checkbook for various reasons. Treasurer's Briefcase supports multiple checkbooks and when it comes time to prepare your end of month reports the software automatically consolidates the activity for all checkbooks into one easily understandable report!

-

What about the end of my fiscal year? Do I have to do any special or complicated close out procedures?

No. Treasurer's Briefcase does not require that you close out periods like accounting packages require you to do. Treasurer's Briefcase automatically and seamlessly rolls into the next fiscal year without any special procedures.

You may however, want to check out our resource section which has some helpful hints on what the Treasurer needs to consider when wrapping up a fiscal year. -

Can I have multiple users?

Yes! All plans allow you to add as many users as you would like. In general you probably do not want to have more than two people with administrative access, however you can add as many users with restricted roles as you would like. Never share your username or password! Adding new users instead of sharing one username will make your financial data more secure.

-

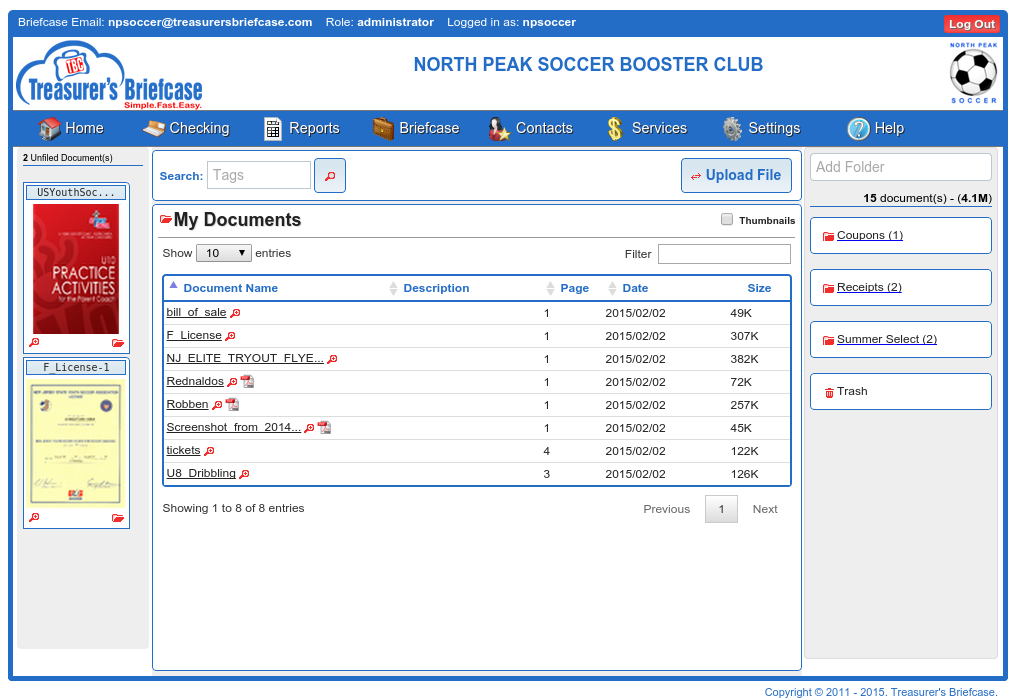

I understand Treasurer's Briefcase has a cloud based file cabinet or briefcase. How long do you maintain these documents?

Treasurer's Briefcase will maintain your documents indefinitely as long as your subscription is current. After 30 days of an expired subscription, your account will be removed from the server. Keep in mind that you can always download your documents and store them on your own computer.

-

What are my filing requirements with regard to the federal and state government?

Small nonprofit organizations must file federal tax returns as well as state returns if you are soliciting funds from the public as a “charitable organization” as defined by Internal Revenue Code 501(c)(3). Our Resource Center contains a detailed map by state, listing your yearly filing requirements as well as any state registration requirements for new entities.

-

Is Treasurer's Briefcase accurate and does it do all the accounting for me?

Yes, you never have to worry about accuracy or formula errors. The software was created using state of the art technology and is tested extensively by a CPA firm before new versions are released.

The software does all the postings and report compiling behind the scenes. All you need to do is select the period and push the button to generate your reports for presentation to your members and board. -

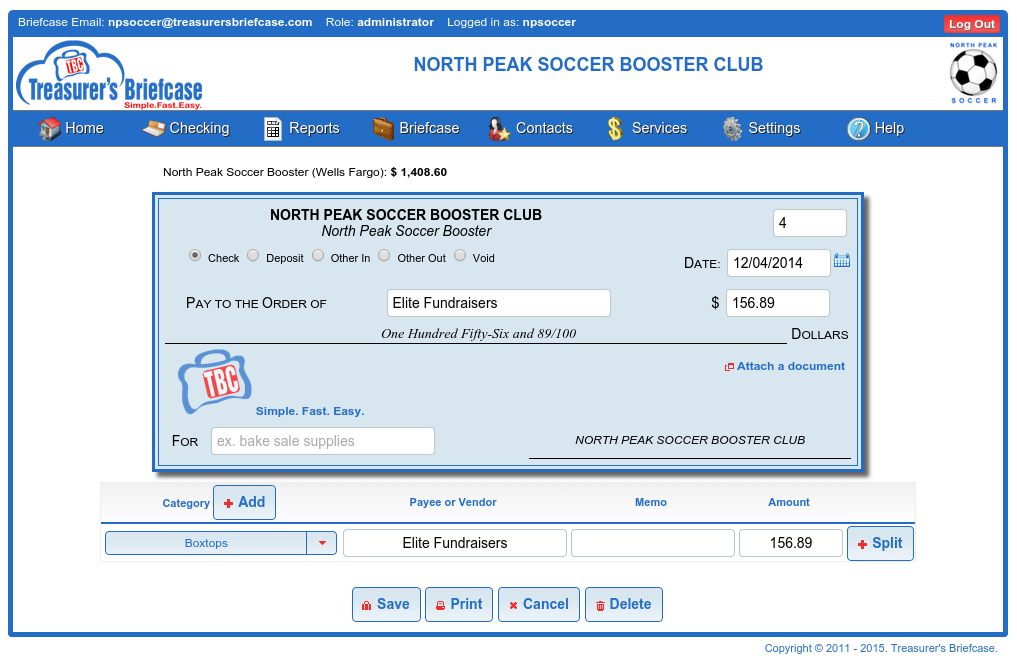

How do I send a document to my briefcase?

You can upload documents from your computer directly into the Briefcase or you can mail the document to your Briefcase.

When you first signed up for Treasurer's Briefcase an email address was assigned to your account. Just send one or more documents to that address as an attachment! The document will appear in your Briefcase in about a minute. You can send:

Word (.doc, .docx)

Excel (.xls, .xlsx)

PDF (.pdf)

Our conversion software will even take your Word and Excel files and create a PDF for you! -

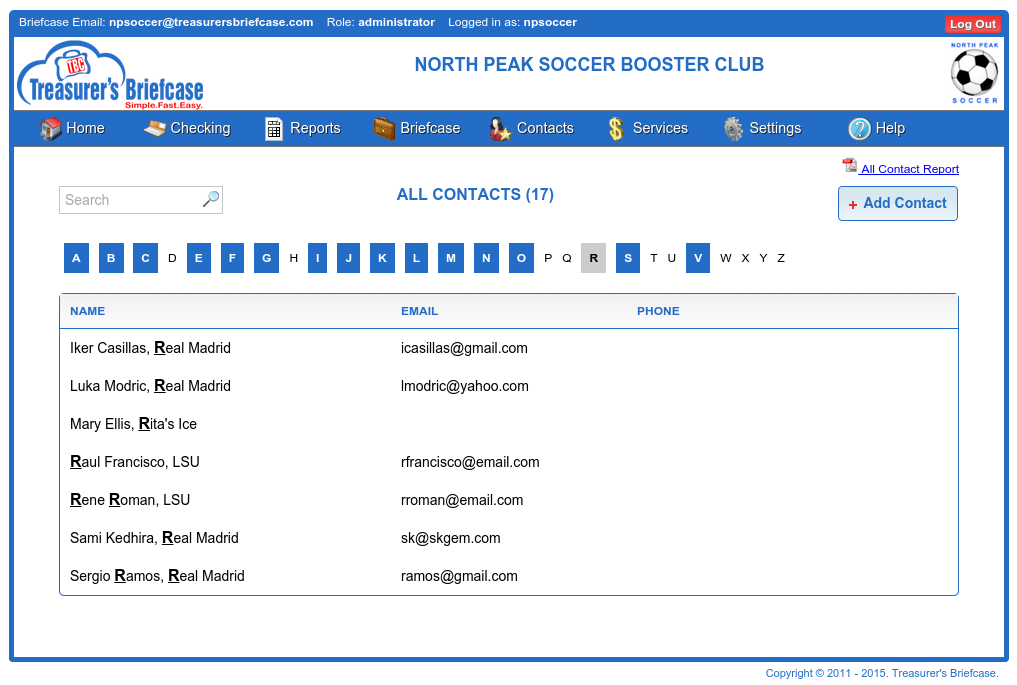

How can I add a contact?

Contacts are added automatically by the system using our proprietary smart contact feature. Every check or transaction that you enter that references a contact allows you to quickly add a contact to the database.

Once the contact is added to the database, click on the Contacts menu item on the main application screen to edit other details for the contact or to add new contacts. -

I already use Quicken. Why should I use Treasurer's Briefcase?

Quicken is a great accounting package and some folks find everything they need in packages like that. But what about the next treasurer? Will they have access to the software? Will they know how to use it? What about documents? Are they still in paper form and need to be handed down from treasurer to treasurer?

Treasurer's Briefcase is a solution that transcends the term of one treasurer. You probably want to step aside some day and let someone else take over. Treasurer's Briefcase makes the transition Simple, Fast and Easy! -

How do I record an expense paid for with cash?

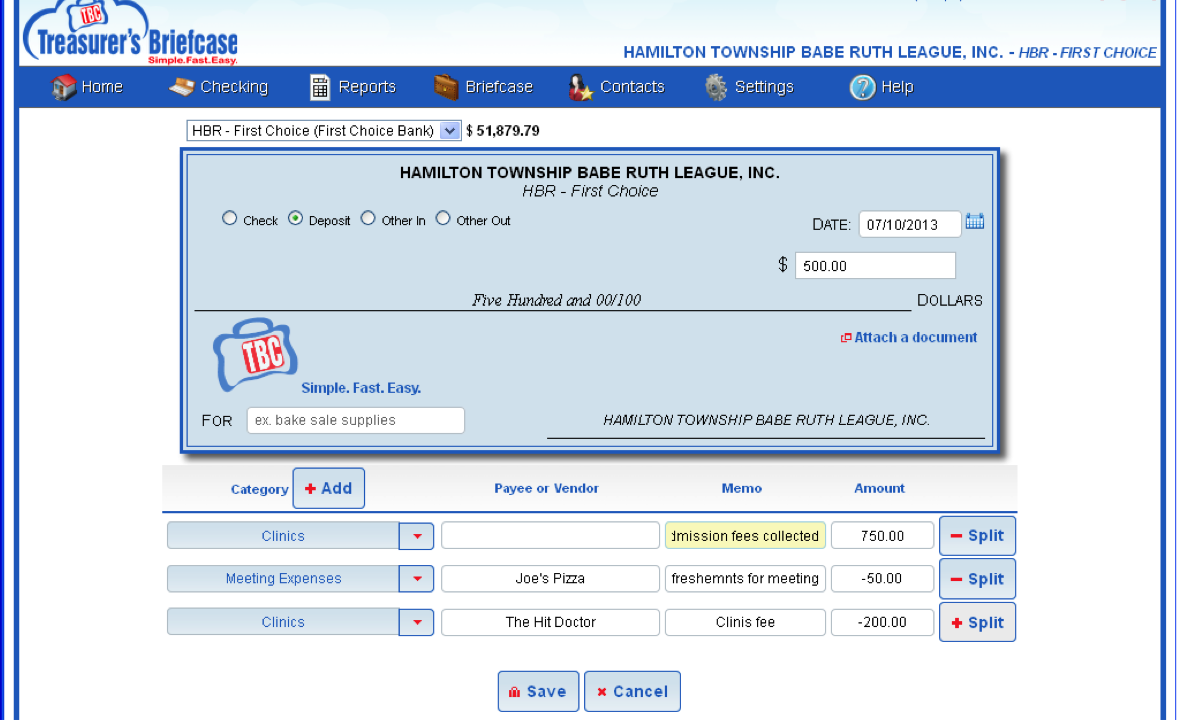

It's important to ensure that all income and expenses are accounted for in order to guarantee that your financial reports accurately reflect the organization’s fiscal status and the organization will be able to fully evaluate the results of fund raising efforts when all the expenses and income are properly accounted for.

Occasionally an expense is paid for with cash generated during fundraising activities, prior to the funds being deposited into the bank. To ensure the expense is captured, you will want to enter it as a negative amount on the deposit entry in Treasurer’s Briefcase.

If your organization frequently has this type of expense, set up a cash account, commonly called “Petty Cash” by adding a new checking account with that name. This account represents un-deposited funds kept on hand for immediate expenses. The Petty Cash account is treated just like any other bank account and should be reconciled every month.

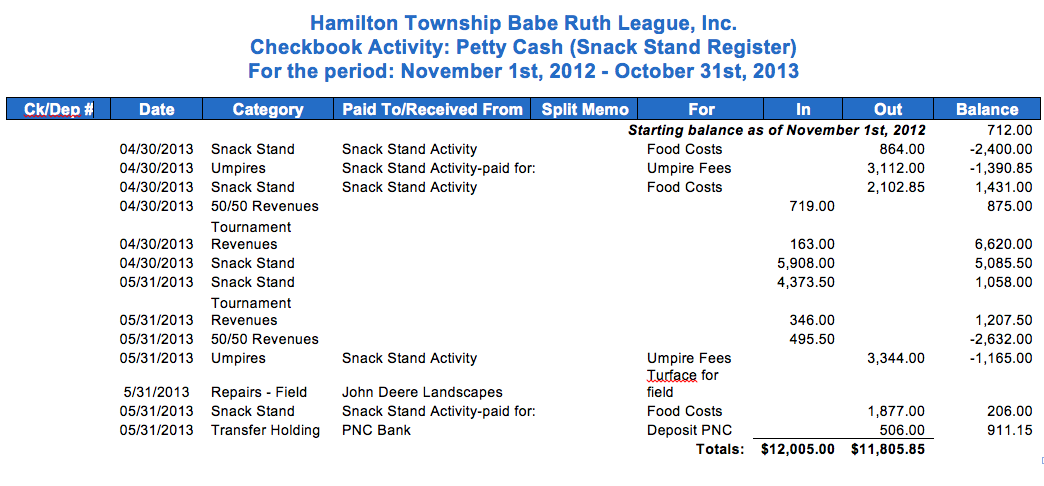

For those organizations having significant cash activity, we suggest creating a new checkbook labeled Petty Cash or Cash on Hand. If, for example, you run a baseball league and the snack stand maintains a steady cash balance, paying certain league expenses from daily proceeds is common. You might create a checking account called “Snack Stand Register”. Although this isn’t truly a checking account with a bank, you would set this account up under the Settings menu just like any other checking account.

Record the daily ins and outs for the register using other in and other out as shown in the example below.

Create a category under the Administrative section called Transfer Holding Account. When excess funds are finally deposited into your organization’s checking account, record the funds being moved from the Cash on Hand or Petty Cash account to the bank account by recording an other out and posting it to the category Transfer Holding.

Open the checking account for the bank to which you deposited the funds and record the deposit again posting it to the Transfer Holding category. The effect of these two transactions is to decrease the cash on hand and increase the cash in the actual checking account. The balance of the Transfer Holding Account will now be zero therefore having no impact on your Treasurer’s Report.- When I click on a report I get a message that says that the report cannot be generated. What's going on?

One-click reports were designed to allow treasurers to quickly access necessary reports.

Our thinking here was that treasurers would want to generate a report for the previous month's data when preparing for a monthly meeting for example. This means that if you have not entered any transactions for the previous month, then the report would not contain any relevant data.

If you want to specify the date range for the report or generate a report for the current month, current year or previous fiscal year, use the Custom Reports option.- Can I change my PIN number?

No. The PIN number that is assigned to you is one element of your secret key for encrypting your documents in the cloud. Once the PIN has been assigned, that PIN is used to encrypt every document that you upload to Treasurer's Briefcase.

If you forget your PIN, your administrator can request that the PIN be sent to them in an email. Only administrator's can request the PIN number.- Which browsers does Treasurer's Briefcase support?

We support all modern browsers.- Chrome

- Firefox

- Internet Explorer

- Safari

- How can I add a custom logo?

You can add a custom logo to your reports! Treasurer's Briefcase will support .jpg or .png files.

Just access your briefcase and click the Upload button. Check the box labeled Custom Logo and the graphic will be sized to display as your group's report logo.- How do I renew my subscription?

If you subscribed using PayPal, your subscription will automatically renew on the anniversary of your subscription assuming your PayPal account is still active.

If you paid by check, be sure to submit payment prior to your expiration date to insure your account stays active.- What happens if I fail to renew my subscription?

If you do not renew your subscription, your account will become inactive. You can still access your data and print reports, but you will be unable to enter any new transactions.

You can reactivate your account by submitting payment. If you need to have your account unlocked immediately, please contact customer service.

If you do not reactivate your account within 60 days, Treasurer's Briefcase reserves the right to delete your account and any documents stored on our servers.- Can I use Treasurer's Briefcase for organizations other than PTOs or Booster clubs?

Absolutely! When you set up your account, select Other when asked to select an organization type.

We've created custom setups for some types of clubs and will continue to add more. The custom setup simply adds commonly used categories for our Programs and Fundraisers.

If you do not see your club type, just pick Other and select the Setup->Categories menu to setup your Programs and Fundraisers. Not all non-profit organizations will need to add those categories.

If you have any questions, please call or email!- How do I handle expenses or revenue recorded in the wrong fiscal year?

There may be times when you pay for something or receive revenue and record it in the wrong fiscal year. For example, you may be required to pay a deposit in June for the fair in September. If your fiscal year ends on June 30th, the expense was recorded in the "wrong" fiscal year.

Because Treasurer's Briefcase is designed for cash basis taxpayers, expenses and revenue recorded within the fiscal year are considered part of your financial picture as far as reporting and reporting on your 990 tax return is concerned.

Here's how you can make sure the expense is shown in the correct fiscal year.

Let's go back to our example. We wrote a check in June for a program we will hold in September, but our fiscal year ends in June.

- Create a dated entry in June as an Other In for the amount of the check.

- Assign it to the same category as your check for that expense. That will, in essence, wipe out the expense in the last fiscal year.

- Now add an Other Out in the new fiscal year for the amount of the check you made out in the last fiscal year and assign that to the proper category. Now that expense will show up in the current fiscal year in your Category and Treasurer's reports.

- When you reconcile your checking account in July, clear both the Other In (that you dated in the last fiscal year) and the Other Out from the new fiscal year. Your account will now balance and you will see the expense in the correct fiscal year.

- What's the difference between a user and a member?

You can use the contact management page to keep track of the members of your organization in additon to contacts and vendors that you interact with from an financial perspective.

Our Smart Add ® feature automatically captures every person or company that is a payee for a check. Some of your payees might be organization members so we allow you categorize certain contacts as members. You can print out a report of all contacts or only those contacts that are members.

If you want to allow additional people to login to the application, you need to add them as a user. User's will have login names and passwords and should be organization members as well.- Can I change my Briefcase email address?

Yes! Select the Settings>Organization menu item and you can edit the email address and other settings for your organization. It's a good idea to update your address and other important information at the same time.

To change your email address, click on the red pencil next to your current email address labeled Briefcase Email Address:. Enter a new email address. The system will make sure your address is unique to your organization.

Save your changes and make sure you let everyone know where to send those invoices, receipts and other documents!- How do I change my password?

To change your password or recover your account in the event you have forgotten your password, click on the the Forgot Password? link on the login screen.

You'll receive an email that includes a link that will allow you to set a new password.- What does the Check Printing checkbox mean in the checking account setup screen?

In order to be able to use the new check printing feature, you need to enable check printing. Additionally, you will need to enter your bank's routing number and your checking account number if those are not already enter for the account. You must enable check printing for each account that your are going to print from.- When I try to print a check it asks me for my PIN number? What's going on?

Printing checks from the application should only be done by someone with banking privileges (which includes the account administrator). To add additional security when printing checks and since we store each check in your briefcase, you need to provide your PIN number.- When I try to print a check, I see a dialog box that asks me to enable printing. What should I do?

If you want to print checks you will need to enable check printing and make sure you provide your bank's routing number and your checking account number.- Is the check printing feature free?

Yes. For a limited time we will be allowing limited access to this feature. Each user will receive a pre-determine number of printing tokens based on their account type. Each production print of a check will cost 1 token. If you love this feature and run out of tokens and would like more during this trial period, please let us know. We anticipated that in the future, each account will receive a set number tokens with their yearly subscription based on their account type. There may be a fee to purchase tokens above your allocated amount in the future, however no policy has been decided upon as of now. We are interested in your feedback!- Why do I have to enter routing number?

The bank requires that your account number and routing number be printed on the check.- I noticed that the bank's name and address are on the check, but the bank's address is wrong.

The bank's address is based on the address for the bank with the routing number you specified as registered with the Federal Reserve. This is not necessarily your bank's branch address, but it is correct.- Do I need to print using MICR toner or ink?

Not necessarily. Most banks today use OCR instead of magnetic readers to interpret the routing number and account number on checks. To be absolutely sure your bank will process the check use MICR toner for your laser printer (available at most office supply stores) or MICR ink. VersaCheck makes a refill kit compatible with most inkjet printers.- Can I print on blank paper or do I need blank check stock?

Most banks will accept checks on blank paper, however blank check stock is very inexpensive and can be found on the internet or at your local office supply store. Look for the check on top style and for maximum compatibility avoid checks with pre-printed borders.- Can you print on pre-printed checks? Check with our check number, account number, name and routing number alread printed?

No, not at this time. A future version may allow you to print on pre-printed checks. Most likely we will support specific formats like Quickbook, VersaCheck or Peachtree style pre-printed checks.- We require two signatures. Can your checks provide a place for two signatures?

Not at this time. This will be available in a follow-up update to the check printing software.- Can I upload my signature?

Not at this time. This will be available in a follow-up update to the check printing software.- Do you have a check fulfillment service where you print and mail the check for me?

Not at this time. This will be available in a follow-up update to the check printing software. We are currently working with an existing check fulfillment company in order to provide this feature.- I've used all of my check printing tokens. Can I get more?

Yes. For a limited time this feature is free to users and we encourage you to test it out. You can print an unlimited number of sample checks (they will have a VOID watermark) for testing purposes. If you want to print a check without the void, each production print will require 1 token. We've limited the number of tokens in order to gauge overall interest in this feature.- I printed a check but now I have to re-print the check. Can I do that?

Yes, you can edit and then reprint the check. Each print of a check will cost one token, including reprints.- Do you save copies of the check images?

Yes, we store an encrypted copy of each check you print.- Can I upload a logo for my check?

No, not at this time.- I see the TBC logo on the check. Can I remove this?

No, not at this time.- How do I enable check printing?

To enable check printing, access your edit the checking account from which you want to print checks. Access the Settings->Checking Accounts menu and select the checking account to enable. Click edit icon (pencil) and follow the instructions below:- Enter the bank routing number found on the bottom of your check.

- Click the Check Printing checkbox

- If you are using blank checks, check the include check boarder box.

- Can I automatically file documents when I send a document to my briefcase?

Yes! Just attach a document to your email and send the email with a subject line that includes the folder name preceded by the @ symbol. Use hashtags (#) to add keywords so you can search for the document. Example:

Subject: @Receipts #baseballs #bats #helmets #anaconda

- Can Treasurer's Briefcase accepts payments for things like dues and events?

Yes!

You can create your own custom payment page to accept payments from the public or from your members. Funds are deposited directly into your PayPal account and corresponding accounting entries, including all fees are recorded in Treasurer's Briefcase saving your Treasurer hours of time.

- What is the cost for accepting payments?

Because you use your PayPal account for processing payments, the fee you pay depends on your PayPal rate. Most entities will incur a 2.9% + .30/transaction fee from PayPal.

If you are a legitimate non-profit and have submitted the necessary supporting documentation to PayPal you may be eligible for a rate as low as 2.2% + .30/transaction.

Treasurer's Briefcase adds a very small per transaction fee depending upon your subscription level. See our current pricing page for more details.

- How does Treasurer's Briefcase interact with my PayPal account?

Treasurer's Briefcase does not access your PayPal account. We facilitate payments, however funds are deposited directly and immediately into your PayPal account. PayPal fees as well as the small Treasurer's Briefcase transaction fee is deducted by PayPal from the proceeds of the payment.

Treasurer's Briefcase cannot see your account information or balance information and only knows about payments it helps to facilitate.

- How can I issue a refund?

Currently, refunds are handled between you and the party that made the payment. You should use PayPal's account management screens to issue refunds. You will then need to make the necessary adjustments in your Treasurer's Briefcase PayPal checking account to reflect the refund.

- If I issue a refund, will the Treasurer's Briefcase fees be refunded?

Refunds for Treasurer's Briefcase fees are not automatically applied to your PayPal account. E-mail support with evidence of the refund (screen shot of your PayPal refund) and fees will be refunded.

Future versions of Treasurer's Briefcase may include automatic refund processing.

- Can I register people for paid events? How do I know who signed up?

Yes!

Treasurer's Briefcase Payment Portal allows you to register users and accept payments for events. Treasurer's Briefcase provides a Web Payments report that details each registrants name, address and other information provided at the time of payment.

- Do I need a PayPal account to accept payments?

Yes. You must first signup for a PayPal account. You should use the organization's existing PayPal account or set a new account up for the organization. You can start a new account from the Organization Settings menu. Follow the instructions carefully and be prepared to include your bank account information.

Treasurer's Briefcase will not be able to access or manage your PayPal account in any way other than to facilitate payments TO your account.- Does Treasurer's Briefcase automatically record payments we receive from our event page?

Yes. Treasurer's Briefcase records all revenue and fees associated with the transaction. When you setup the event, you select an existing category or you can create a new category at the same time you create your payment page. When payments are made by your members, revenue and expenses are recorded in their proper categories in the Treasurer's Briefcase checking account named PayPal. You can run the Web Payment Report to get a listing of all payment activity.

- What plan should I pick?

We think all groups will benefit from the features of our Standard Plan, however we understand some organizations may have limited funding. As a general guideline we recommend using your annual revenue as a guide, although your needs may vary.

- Basic Plan for groups with revenue < $5K

- Budget Plan for groups with revenue < $25K

- Standard Plan for groups with revenue > $25K

- Does Treasurer's Briefcase charge a fee to accept payments?

Yes. In addition to your normal PayPal fees (either 2.9% + .30/transaction or 2.2% + .30/transaction for 501 (3)(c) organizations approved by PayPal), Treasurer's Briefcase charges a small per transaction fee based on your subscription plan. See our pricing page for more details.

- I'd like to subscribe as a Basic or Budget account but the system won't let me.

If you are currently using features that require a specific level of account then you will not be able to downgrade to a lower priced account unless you stop using those features. For example, if you currently have more than 1 user than you must chose either Budget or Standard or delete your user.

The same situation applies to accounts with more than 1 checking account.

For more information, contact us.

- Do people who visit my payment page require a PayPal account?

No. Payments can be made using a credit card or their PayPal account as long as your PayPal account is a Business account and not an account in an individual's name.- I just entered transactions but they're not affecting my balance? What am I doing wrong?

Make sure you are not entering transactions in the future. If you plan on making a deposit in a few days, you can date the transactions in the future, but they will not show in your balance since the balance reflects data up to the current date. You can still see the transactions if you run an activity report and include the future date in the date range for the report.- When does my subscription expire?

To find out when your subscription expires, access the Settings>Organization menu. The field labeled Subscription End Date will show the date your subscription expires.- Will you send me an invoice when my subscription expires?

No. We will send reminder emails, however to renew your subscription you can print an invoice from the Services>Print Invoice menu item and send us a check or renew by paying by credit card.- What should I use as a username?

Each user of the system should have their own unique login. A good method is to use the person's first initial and last name if that is available. If that is not available, consider a prefix that identifies your organization and then the user's last name.

For example, for Groveville PTA if I have a user whose last name is Smith, I might use gpta-smith

Do not use generic logins like groveville-pta-prez or change the name of a user to re-use a login account. Every contact or user you create must be unique. You may be associating that user with a financial transaction like a reimbursement. If you were to change the name of the user from Mary Smith, to say Betty Jones, transactions associated with Mary might now look like they belong to Betty and there would be no record of Mary in the system anymore!

Always give each user their unique login and deactivate that login when they are no longer associated with the organization. Deactivation keeps the contact in the system, but prevents the user from logging in to the system. It is necessary to have unique logins and deactivate them when appropriate, instead of deleting or changing a user's name to make sure that past financial transactions associated with that contact remain in tact. The system will not permit you to delete a contact or user that is associated with financial transactions.- How can I find a specific transaction?

Using our SmartSearch feature, you can search for a transaction in any one of a number of ways. Our SmartSearch will allow you to search by:

- Check number

- An amount

- By payee or payor

- By date or date range

- Check memo

For more information on our SmartSearch feature click here.

- I'm trying to delete a user or contact, but the delete button is greyed out?

A user in Treasurer's Briefcase is someone who can login and interact with the financial records. A user can have a role of adminstrator, banking or reports. A contact is someone or some company that you may have entered into the system because they were party to a transaction (a debit or credit). Users are also considered contacts and can also be the subject of a transaction.

If the contact or user is associated with a transaction, you cannot delete the contact or user. The system must keep a record of who the transaction was associated with. You can however revoke a user's login or temporarily deactivate a user.

- What roles and privileges can users have?

Treasurer's Briefcase user can have one of three different roles:

- Administrator

- Banking

- Reports

To learn more about roles click here.

- How do I delete a user?

From the Settings>Users menu you can delete a user that is not currently used in any transaction by clicking the Delete button. If the Delete button is greyed out, it indicates that this user is currently associated with a transaction, possibly as a payee. Consider revoking the user's login privileges or deactivating their account instead of deleting.

- I started entering transactions but I have decided to start entering more transactions from older periods. Can I do this?

Treasurer's Briefcase does not close out periods, so you can just enter the transactions from whatever date you would like. You must however adjust the starting balance of your checking account to align with the balance at the time of the earliest transaction you enter. Typically you would use a bank statement to find the ending balance for the month prior to when you might want to begin using Treasurer's Briefcase. For example if I want to start with the transactions from July of 2019, then I would find the ending balance as of 6/30 from June's bank statement.

Keep in mind that if there were outstanding checks that had been written prior to 6/30 - you should record them also. This will deduct them from the ending June balance you just entered ensuring that when that check is finally cashed you have accounted for it in your balance. If you fail to do this or if you were unaware of the check it's still ok...when the check is finally cashed it will show up on your bank statement and you should be able to identify the discrepancy when you do your monthly reconciliation.

Should you decide to enter transactions from prior periods, you should reconcile each month starting from that month forward to make sure that you have accounted for all transactions.

Check out the video here that will show you how to update your checking account balance.

Changing your account balance - When I click on a report I get a message that says that the report cannot be generated. What's going on?

How Treasurer’s briefcase Works